billings montana sales tax rate

- Tax Rates can have a big impact when Comparing Cost of Living. Income and Salaries for Billings - The average income.

Irs Issues Applicable Federal Rates Afr For September 2020

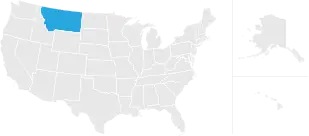

The most populous location in Montana is Billings.

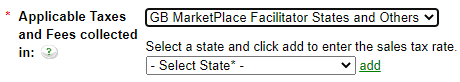

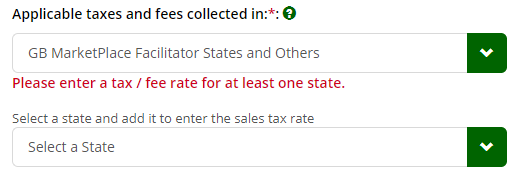

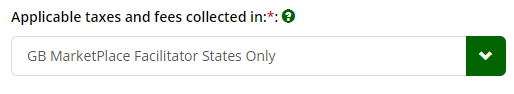

. Billings MT Sales Tax Rate. 2022 Montana Sales Tax By County. Combined tax rate 0 Local rates are set by the county city or other taxing district.

The Billings sales tax rate is NA. Free Unlimited Searches Try Now. 4 rows The current total local sales tax rate in Billings MT is 0000.

The sales tax rate does not vary based on location. This includes the rates on the state county city and special levels. The sales tax rate does not vary based on county.

4 rows The current total local sales tax rate in Billings MO is 6975. There are three main stages in taxing property ie setting mill rates appraising property market worth and taking in payments. Ad Lookup State Sales Tax Rates By Zip.

Free Unlimited Searches Try Now. An alternative sales tax rate of 10 applies in the tax region Billings which appertains to zip code 74630. Billings is located within Yellowstone County Montana.

There is no applicable special tax. Under state law the government of Billings public schools and. Tax rates last updated in July 2022.

The most populous zip code in. Montana has no sales tax. The US average is 46.

Sales tax region name. Bozeman MT Sales Tax Rate. The average cumulative sales tax rate in Billings Montana is 0.

The December 2020 total. Download tax rate tables by state or find rates for individual addresses. The Billings Montana sales tax is NA the same as the Montana state sales tax.

The 785 sales tax rate in Billings consists of 4225 Missouri state sales tax 175 Christian County sales tax and 1875 Billings tax. The December 2020 total. The Billings Oklahoma sales tax rate of 6 applies in the zip code 74630.

Montana has no state sales tax and allows local governments to collect a local option. - The Income Tax Rate for Billings is 69. Click any locality for a full.

While many other states allow counties and other localities to collect a local option sales tax Montana. Montana has 0 cities counties and special districts that collect a local sales tax in addition to the Montana state sales tax. Download tax rate tables by state or find rates for individual addresses.

Ad Lookup State Sales Tax Rates By Zip.

Montana Income Tax Calculator Smartasset

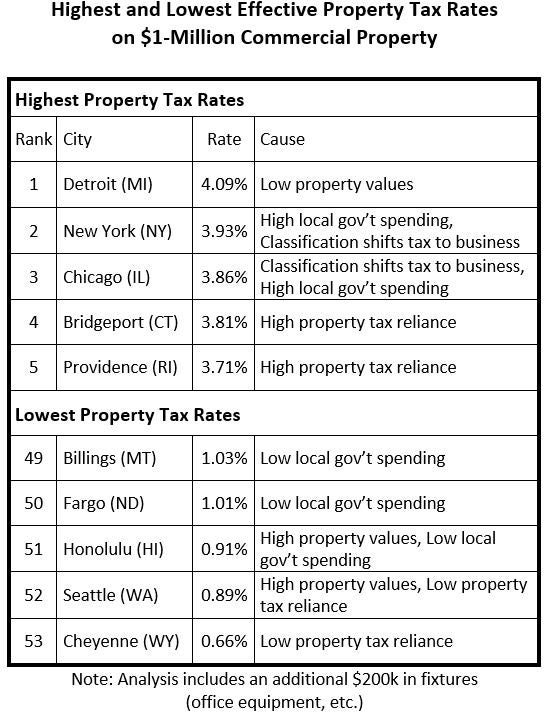

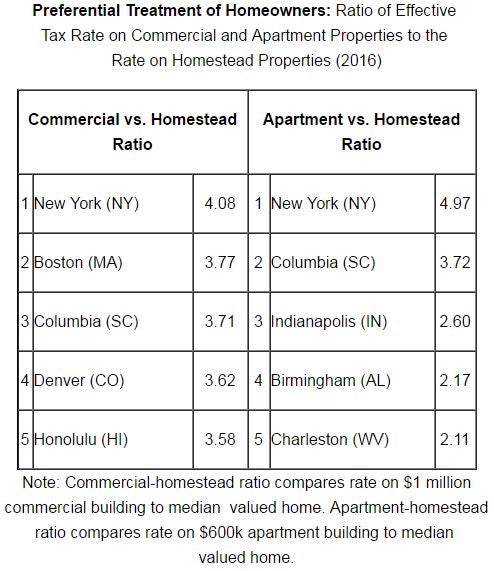

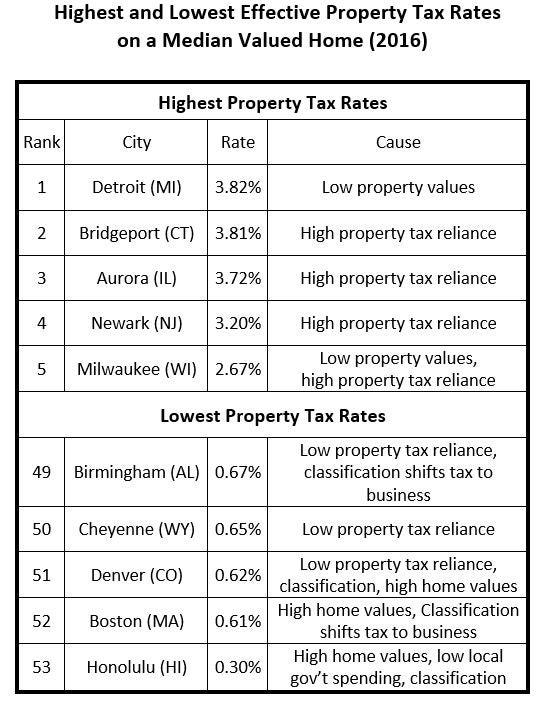

These Are The Cities With The Highest Tax Rates And The Lowest Cheapism Com

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Aaonannualreport2020 Annual Report Ars

These Are The Cities With The Highest Tax Rates And The Lowest Cheapism Com

Montana Income Tax Calculator Smartasset

Sales Tax Collection Up But So Is Inflation

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

North Dakota Sales Tax Calculator Reverse Sales Dremployee

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 3

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy